High-fidelity income and expense definition is key to high-fidelity projections. It may take some extra effort to specify your inputs, but once it’s done it’s just a matter of keeping it up to date and the benefits are forever.

Pralana Gold can model numerous income and expense streams along with the typical nuances that tend to correspond to the various types of income and expenses. Here are some income and expense page screenshots to illustrate:

Employment Income

Employment income streams can include personal and company-matching contributions to tax-deferred, Roth and Health Savings accounts. Further, they can optionally include Social Security taxes and self-employment taxes.

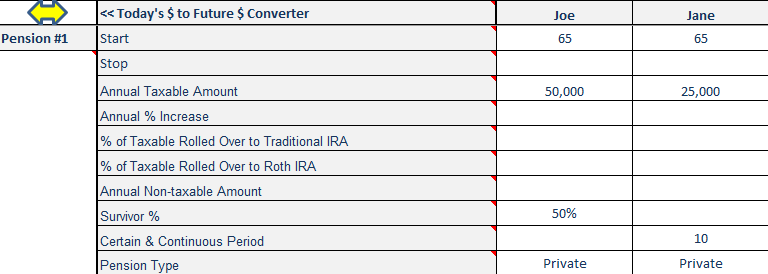

Pension Income

Pension income streams can include rollovers to traditional and Roth IRA’s and non-taxable amounts and can model survivor options.

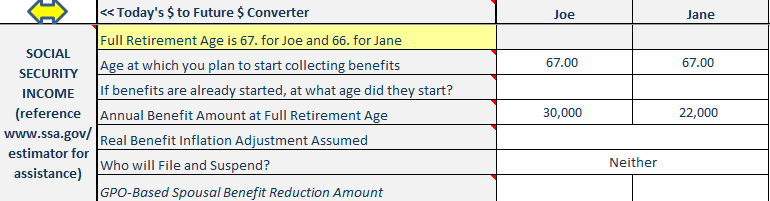

Social Security Income

You specify your benefit at Full Retirement Age and Gold will calculate your actual benefit as a function of your actual start age. Spousal benefits will also be calculated for both partners. File & Suspend and Restricted Applications are fully modeled.

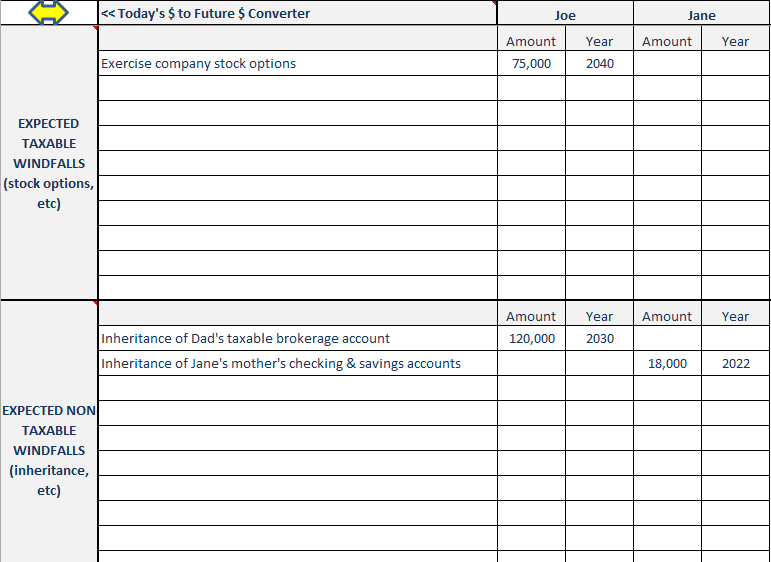

Windfall Income

Up to 10 taxable and 10 non-taxable windfalls for both husband and wife can be modeled.

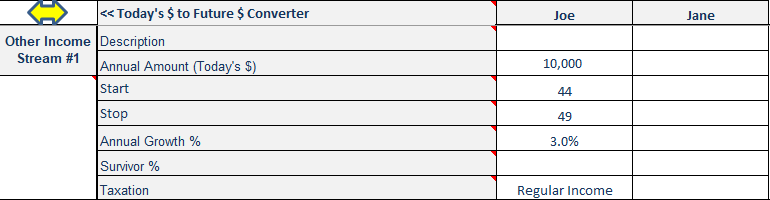

Other Income

Five streams of Other Income for both husband and wife can be modeled, and each of these streams can be treated as ordinary income, long-term capital gains or non-taxable income. Survivor options can also be modeled.

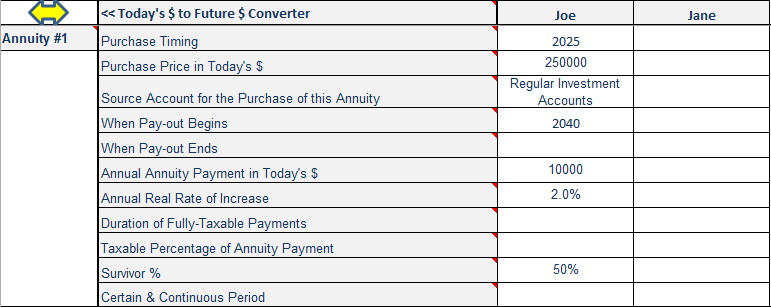

Annuities

The purchase and pay-out of two annuities for both husband and wife can be modeled, and this includes survivor options.

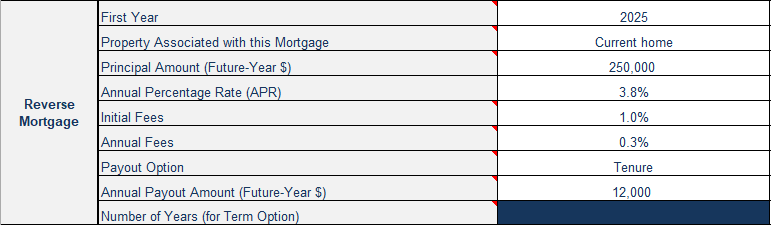

Reverse Mortgage

A reverse mortgage can be modeled on one property, and payout options include lump sum, tenure and term.

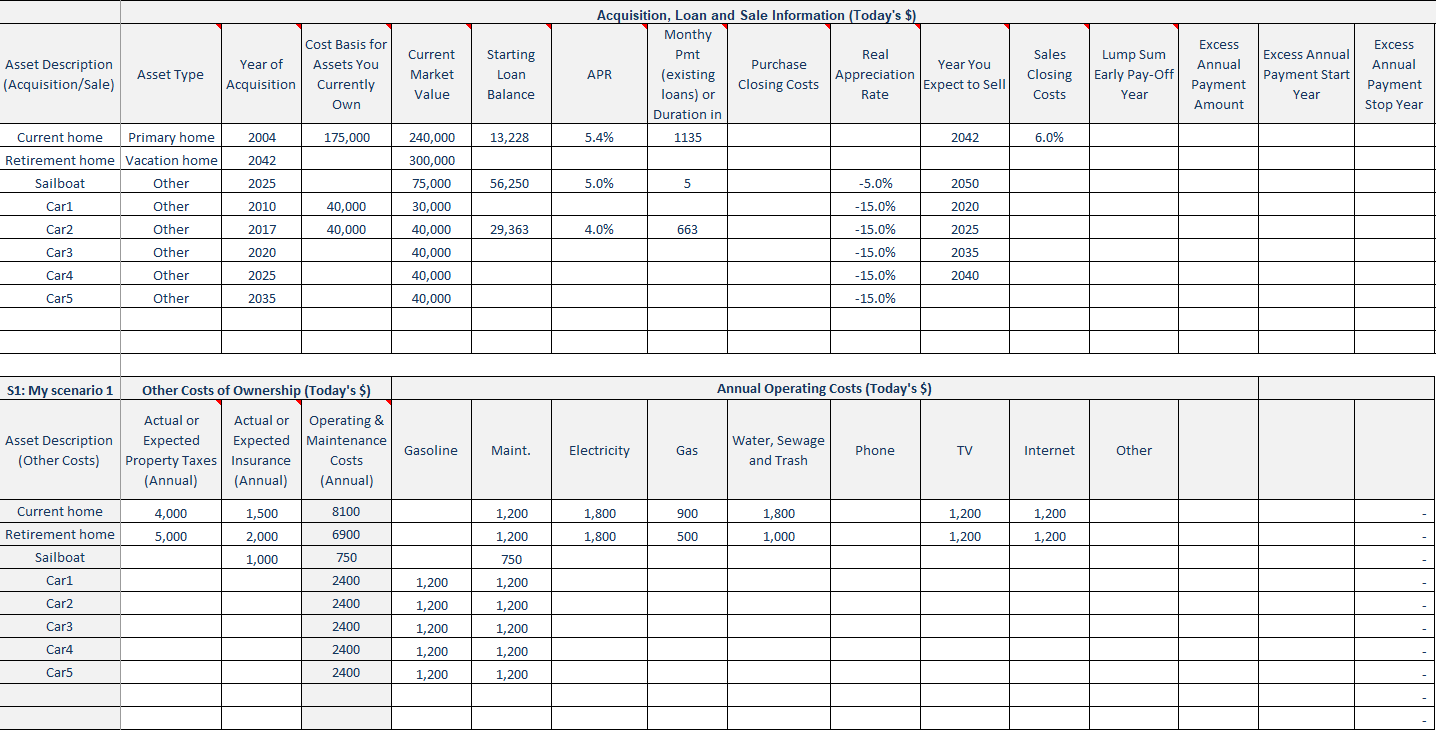

Purchase, ownership and sale expenses of up to 10 personal and 10 rental properties can be modeled, and this is fully integrated with the tool’s tax calculations.

Home and Other Property Expenses

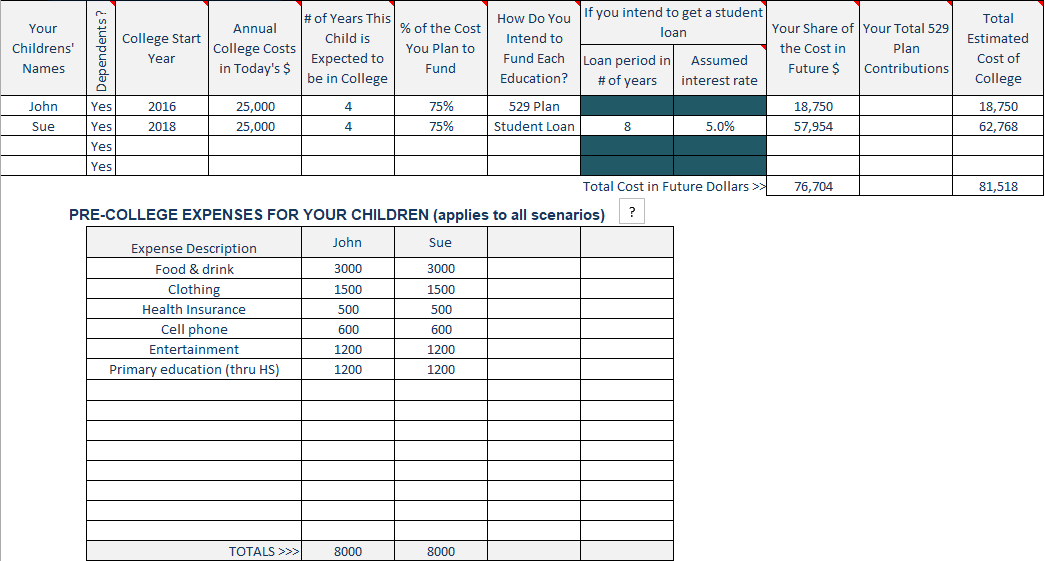

Children’s Expenses

College education expenses for up to four children can be modeled, and this includes 529 plans, student loans and pay-as-you go options.

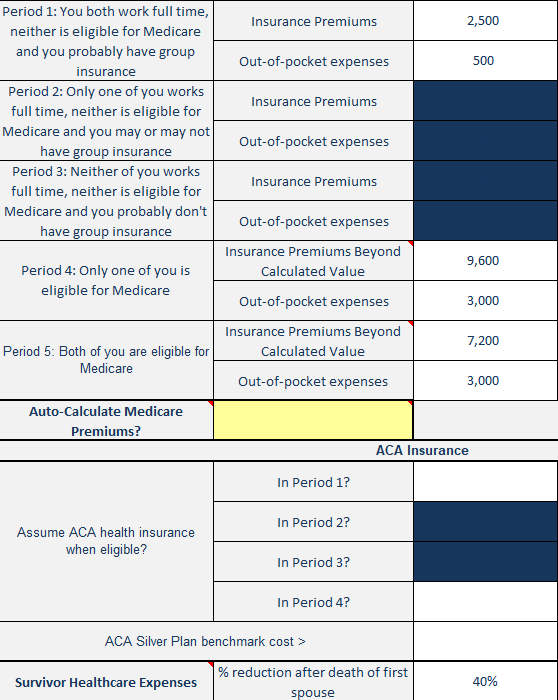

Healthcare Expenses

Healthcare expenses are modeled across up to five typical time periods, over which expenses can vary significantly: while both partners are working, while only one partner is working, when neither partner is working and not yet eligible for Medicare, when only one partner is eligible for Medicare and when both partners are eligible for Medicare. This also includes modeling of ACA policies and automatic calculation of Medicare Part B, along with IRMAA adjustments.

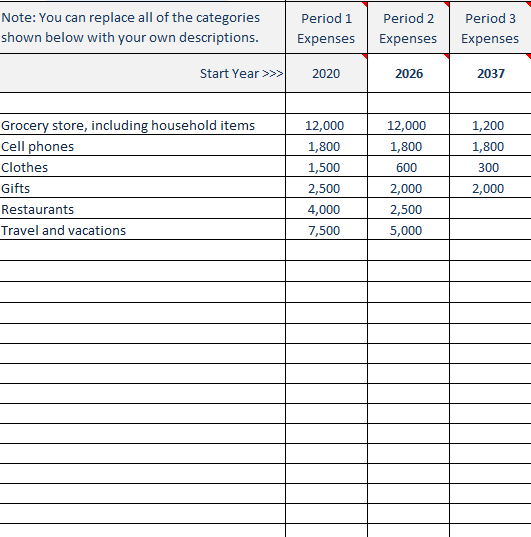

Discretionary Expenses

Discretionary spending across three different user-specified time periods is modeled. Typical periods might be pre-retirement, early retirement and late retirement, but it’s totally up to you how the time is partitioned. All expenses are adjusted for inflation.

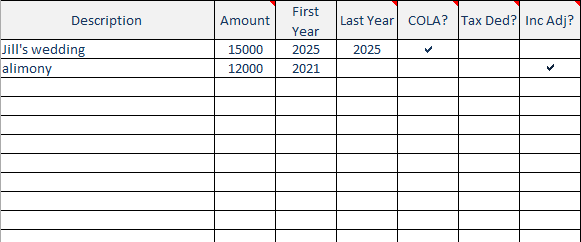

Miscellaneous Expenses

Do you anticipate some one-off expenses such as a big wedding or a once-in-a-lifetime vacation? These can be modeled as Miscellaneous expenses. But the tool can also handle unique expenses that span multiple years and/or have unique taxation characteristics such as alimony.

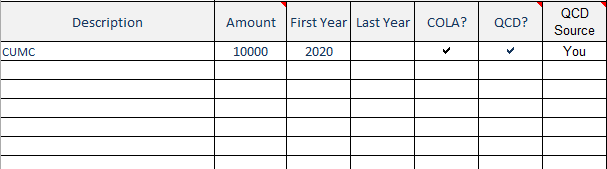

Charitable Giving Expenses

Charitable giving expenses are modeled and this is fully integrated with the tool’s tax calculations. Are you familiar with Qualified Charitable Donations? If not, you should be if you make charitable donations. If these are made directly out of your tax-deferred account after you reach age 70, these donations can count as part of your RMD and they are excluded from your taxable income even if you use the standard deduction. And Pralana Gold models this.

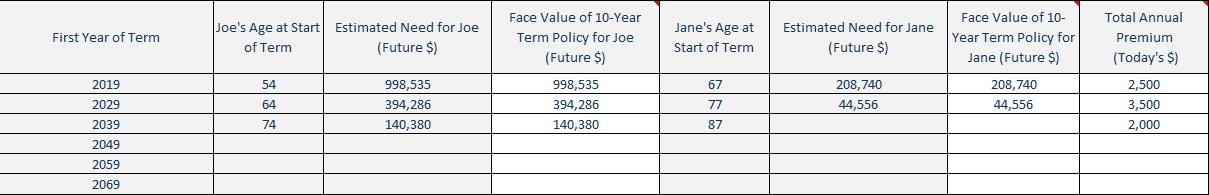

Term Life Insurance

Pralana Gold will calculate the amount of term life insurance that both you and your spouse need to maintain your standard of living in the event of the untimely death of the partner. You can then choose to modify that value as you desire and specify the associated insurance premiums. Naturally, this life insurance has a key role while investigating survivor scenarios.

Cash Value Life Insurance