Pralana Gold models diversified assets and the unique taxation characteristics of taxable, tax-deferred and tax-free accounts. The benefit to you is the highest possible fidelity in the modeling of your account balances and the related tax expenses.

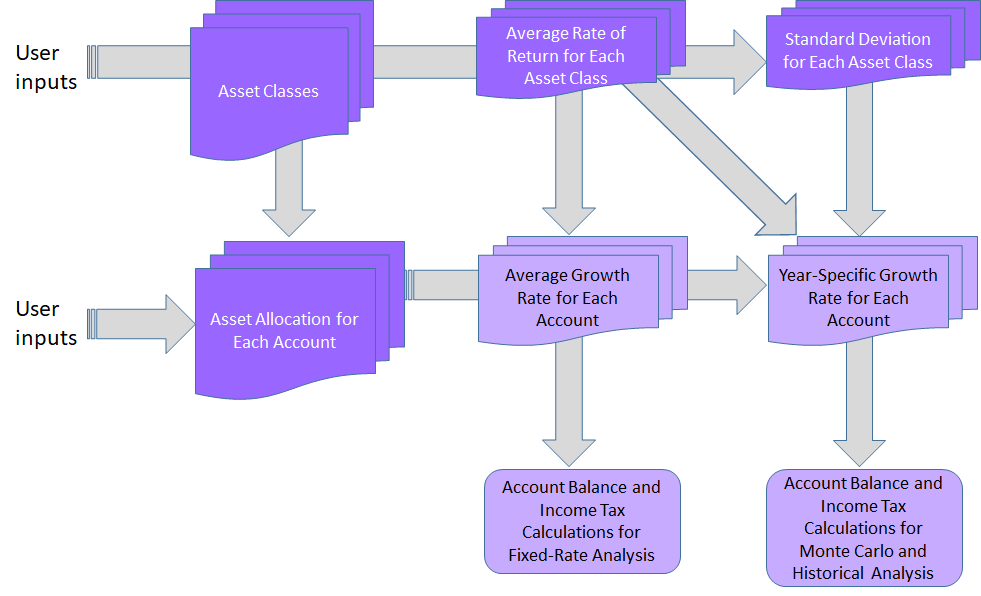

You specify the initial balances for all accounts, the initial unrealized capital gains for taxable accounts and the initial after-tax contributions to tax-deferred accounts. You specify the taxation characteristics of your taxable account. You specify and characterize up to 10 asset classes (such as money market, stocks and bonds) and the asset allocation for taxable, tax-deferred and Roth accounts for up to five separate time periods. You specify the withdrawal order to be used if and when you have a negative cash flow. Pralana does the rest.

The rate of return for each account is a function of the underlying assets and asset allocations. The derived rate of return governs the growth of each account, and Pralana Gold accurately models both this growth and the taxes on this growth. Further, the assets and asset allocations associated with each account is the key factor in the simulation of sequence-of-return variations in Pralana Gold’s Monte Carlo and Historic analyses!

taxable accounts

Growth of taxable accounts can be a combination of simple interest, qualified dividends, capital appreciation taxable only upon withdrawal (and then taxed as long-term capital gains), or tax-free. You have control over the mix that most closely matches your actual portfolio.

tax-deferred accounts

Growth of tax-deferred accounts is not taxed until it is withdrawn, and then it is taxed as ordinary income.

roth accounts

Growth of Roth accounts is never taxed.