Why the US economy is doing so much better than the rest of the world

It happened again — the US economy defied yet another forecast in a big way.

Economists were convinced the last quarter of 2023 had to be the one where economic growth slowed significantly after the prior quarter’s gangbuster 4.9% annualized growth rate. Gross domestic product, the broadest measure of economic output, did slow last quarter to a 3.3% annualized rate. But make no mistake, as Larry David would say, that’s prettaaay, prettaaay good. It’s remarkable given economists were expecting 1.5% annualized GDP growth last quarter. It’s even more remarkable considering a year ago they were all but certain there’d be a recession by now and the economy would grow at a meager 0.2% rate.

But what’s perhaps most remarkable about the US economic growth rate is how much it towers over similarly sized advanced economies.

For instance:

- The combined GDP of the 20 countries that use the euro grew at an annualized rate of just 0.1% in the third quarter of last year

- The UK is growing at a 0.2% annualized rate, according to the latest GDP estimate from November

- Japan’s economy shrank by 2.1% in the third quarter of 2023 compared to a year prior

https://edition.cnn.com/2024/01/26/economy/us-gdp-other-countries/index.html?ref=aussienomics.com

Yes 1st quarter GDP for 2024 was less than last 1/4 2023, but....

Last quarter’s (first 1/4 2024) GDP snapped a streak of six straight quarters of at least 2% annual growth. The 1.6% rate of expansion was also the slowest since the economy actually shrank in the first and second quarters of 2022.

The economy’s gradual slowdown reflects, in large part, the much higher borrowing rates for home and auto loans, credit cards and many business loans that have resulted from the 11 interest rate hikes the Fed imposed in its drive to tame inflation.

Even so, the United States has continued to outpace the rest of the world’s advanced economies. The International Monetary Fund has projected that the world’s largest economy will grow 2.7% for all of 2024, up from 2.5% last year and more than double the growth the IMF expects this year for Germany, France, Italy, Japan, the United Kingdom and Canada.

Businesses have been pouring money into factories, warehouses and other buildings, encouraged by federal incentives to manufacture computer chips and green technology in the United States.

WASHINGTON, June 11 (Reuters) - The World Bank on Tuesday said the U.S. economy's stronger-than-expected performance has prompted it to lift its 2024 global growth outlook slightly but warned that overall output would remain well below pre-pandemic levels through 2026. The World Bank forecast global growth of 2.7% in both 2025 and 2026, a level well below the 3.1% global average in the decade prior to COVID-19. It also is forecasting that interest rates in the next three years will remain double their 2000-2019 average, keeping a brake on growth and adding debt pressure to emerging market countries that have borrowed in dollars.

U.S. BUOYANT

On the upside, the World Bank said that the U.S. could continue to surpass expectations, boosting global growth with lower inflation if elevated productivity and labor supply due to immigration prove persistent.

Draghi urges radical European Union reform requiring extra 800 billion euros a year

The bloc’s goals of bolstering its geopolitical relevance, social equality and decarbonization are being threatened by weak economic growth and productivity compared with the U.S. and China, the report states.

Equities excluding the US are tumbling, with an MSCI gauge at its lowest in three months. An index of developing-market currencies has lost more than 1% following the US election, coming close to erasing this year’s gains. European stocks and the euro have flopped.

The stark divide between US and non-US assets has become more pronounced as Trump’s cabinet starts to take shape, with loyalists ready to carry out his “America First” proposals named for key posts. That has confirmed the worst of investors’ fears: that the push for higher tariffs, particularly on China, will gain momentum, alongside a host of potentially disruptive policies that can drive inflation higher and bind the hands of central banks.

Such worries have prompted investors to park their money in US assets. Fund managers’ exposure to American stocks jumped to the highest since 2013, according to a survey from Bank of America Corp. On the other hand, emerging markets such as China and Mexico, often seen as the most vulnerable to Trump’s trade policies, have taken a hit.

https://finance.yahoo.com/news/global-markets-reel-trump-america-034031299.html

Talent flight to wealthier countries of the north is a problem Portugal shares with several others in southern and central Europe, as workers take advantage of freedom of movement rules within the trade bloc. Countries including Italy have tried other schemes to counter the flight, with mixed results.

Donald Trump’s victory in U.S. elections this month raises the stakes, with the risk of across-the-board trade tariffs on European exports of at least 10% – a move that economists say could turn Europe’s anemic growth into outright recession.

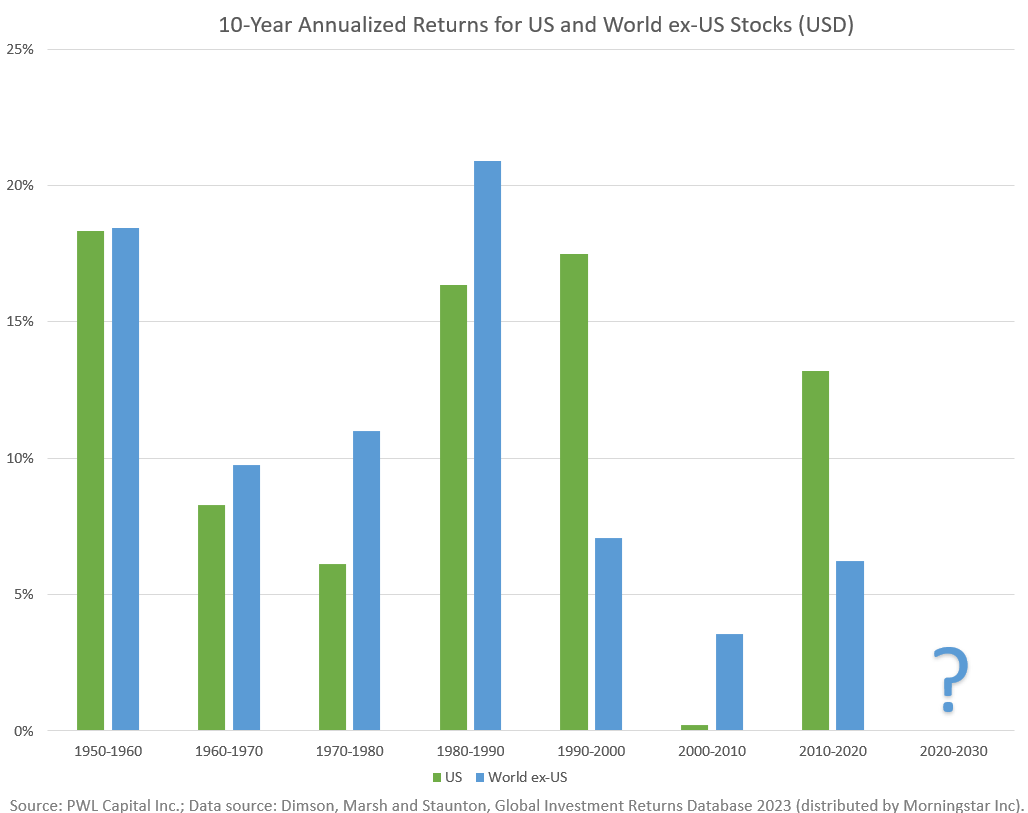

The US stock market has seen a record-breaking month, with the S&P 500 rising 5.7% in November, driven by optimism about President-elect Trump's trade policies and expectations of rate cuts and steady economic growth. In contrast, global markets have been sluggish, with Europe's Stoxx 600 gaining only 0.4% for the week and investors pulling money out of European and emerging markets. The US has dominated global markets for 13 of the past 15 years, and the momentum is expected to continue, with tech giants driving growth and Trump's policies expected to boost the economy.

https://finance.yahoo.com/news/us-stocks-skyrocket-while-global-194012707.html

'U.S. economy is outperforming the rest of the world even with still-high interest rates,' says DataTrek's Nicholas Colas

Treasury bond yields are clearly influencing how U.S. stocks behave this year relative to equities in the rest of the world, with the S&P 500 outperforming in 2024, according to DataTrek Research.

"Ten-year Treasury yields have been the most important driver of marginal global equity dollar-based returns this year," said Nicholas Colas, co-founder of DataTrek, in a note emailed Tuesday. "The relationship is clear," he said; when yields on the 10-year Treasury note rise or are stable, U.S. stocks outperform, but when they fall, "rest-of-world stocks do better."

Check out the latest podcast by David Stein for his take on the reasons for US vs Global performance: https://moneyfortherestofus.com/503-us-stocks-overhyped-expensive/

Here is an interesting article looking at if now is the time to increase (or start using) international investments because of US dysfunction:

https://www.cnbc.com/2025/04/17/us-stocks-international-stocks-trump-tariffs.html

Finally got around to listening to the podcast recommended by @wallace471 on December 6th, 2024 - Wow! a podcast filed with facts and supporting documentation, it is a must listen!! 🤩 😍 It explains why I and many others who invested primarily in US stocks over the last 10-15 years did so well. I will admit it did raise some concerns about US stocks going forward related to deficient spending by the US government. Now add in the craziness of the present administration and I can under stand the growing uneasiness. Not sure developed markets will gain that much over the US going forward, but worth keeping an eye on. I am staying fully invested in US stocks (equity portion of the asset allocation) but looking behind my shoulder 🧐.

Just listened to "Money for the Rest of Us" podcast episode 521, which is basically an update to episode 503 recommended by @wallace471. Another must listen! I am definitely looking over my shoulder 🤔 🤔 🤔.

https://moneyfortherestofus.com/521-selling-america/

@pizzaman I have to laugh a bit that you cited the Cedarburg et al article, given your criticism of their conclusions in the other more recent thread. 🙂

This is the same database they used to draw their "50% domestic/ 50% international" stock recommendation, over the 60 domestic stock/40 domestic bond and age based AA.

I'm not willing to ditch bonds. But I do like their 50/50 domestic/foreign. My reason for preferring 50% international stock is quite simple: I'm investing in the asset class (equities), and not the "country". This is especially important given the cognitive distortion of home bias, that seems universal. The relationship between stocks and a country's economy is nebulous; high GDP doesn't translate to high equity returns, nor does the opposite; valuations are inversely correlated, but with wide variation. I'm still putting a lot of faith in my own country with the 50% american equity allocation.

@jkandell I thought you would find that funny 😀. I laugh every time I look in the mirror 🤣. I agree in not dropping bonds, in my case a US Treasury bond ladder. I also agree that we do not invest in countries, but in companies. Having said that, the type of companies that you can invest in vary based on what country that are based in. For example, no other country has the magnificent 7 that the US has. Microsoft and Meta just released stellar results, again. The mag 7 together are worth more than many countries. They are not one trick ponies, Microsoft has been around since the 1970's. I guess I don't look at companies, where they are based or even what they do. When it comes to how I invest my retirement fund accounts, what I am buying or investing in, and the only thing I care about, is Rate of Return (ROR) in the context of my level of risk. Just like shingles, a Dollar Doesn't Care where it came from. All it knows is that it is green and can be used to buy things, pay bills, etc. Investments are converted to dollars and then transferred to your checking/saving account and then spent. Right now the best ROR is the US Stock market. If there is great evidence that foreign stock markets will start out performing the US for more than a quarterly or two, I would have no problem investing in developed foreign markets. But we aren't there yet. Sorry for drifting into the metaphysical ether 🙃.

@pizzaman It's important to keep eyes wide open and not just base strategy on "what has always happened" but also what's happening in front of us in real time. We've garnered actual hate/resentment against us, by friend and foe, around the world. They're boycotting our stuff and setting up their own long-term trade deals. They're working as hard as possible to decouple themselves from our dollar and economy. These things won't be undone if/when we choose new leadership. We've caused a lot of pain to the rest of the world, and that memory becomes generational.

That said, international has a track record of outperforming already:

@hines202 I agree with you about our current situation "in front of our face"; but having accepted that, I find it impossible to draw conclusions for my investing. Not only are we not able to predict whether tariffs will remain (e.g. are they the new normal or are they just a method of extortion? And/or will judicial and popular opinion force change?), but we don't know how things will play out internationally, or how that all will affect equity returns specifically. From my reading of the research, there isn't even a clear relationship between the amount of democracy in a given country and its equity returns. This is why I aim diversified internationally. The most I can expect is to capture some of the risk premium of equities as an asset. One of my biggest aha moments in learning about investing was the realization that good companies in themselves don't equate to high equity returns, and the same with "good countries".