I am in the 12% bracket forever with all Roth conversions disabled. I'm pretty close to the upper limit for the bracket. If I optimize Roth conversions, it uses a 22% bracket for the first two years, and recommends a large conversion since it is filling up the entire 22% bracket. It also puts me into an IRMAA situation. This doesn't seem intuitive to me. Why would it do this?

My portfolio is very heavily tilted toward traditional IRA (80% of total.) Is PRC suggesting that it's worth paying tax at the 22% level for two years to save on RMD taxes later on?

The program is optimizing the final estate value on an Effective (after taxes on the tax deferred balance) basis. There are many phase-ins in the tax code that create zones of high tax rates that the program may be trying to avoid - SS benefit taxation, LTCG taxes, far future NIIT (since it's not adjusted for inflation), future IRMAA surcharges, etc. For instance, since you are near the top of the 12% bracket, you may have some LTCGs being taxed, which creates a zone where extra income like RMDs would be taxed at 27% (12% ordinary + 15% LTCG), so Pralana may be biting the bullet to move away from that in the future.

However, the optimizer only searches ordinary tax brackets. Since that put you over an IRMAA tier, those last few $ of conversion may not be helping you. You can manually test whether it would be better to back off and not pay that IRMAA cost by selecting to limit conversions to the base IRMAA tier ($106k or $212K). If the difference in final value due to avoiding IRMAA charges now is small, I would lean towards staying under the IRMAA limit. Note also that like all optimizers, Pralana's Roth Optimizer will select even very marginal conversions as long as they make a little money. So I would test fewer conversions in general to see which ones have the most bang for the current tax bucks.

In our case, after some initial, very positive conversions, the optimizer recommends lots more conversions that don't add that much value and I'm not inclined to do all those. The reason is that Roth Conversions can hurt you if we get a bad sequence of returns. It's worth your time to prove that to yourself by selecting Historical Analysis and click the Activate Historical Sequence button near the top and select an unlucky sequence like 1965. Do that with Roth Conversions enabled and with them disabled and see what happens to your final estate value - like doing anything that adds risk, Roth Conversions may hurt you if we get bad market performance.

A couple things to check to make sure you are getting sensible answers.

Note that if you hold different asset allocations in different accounts (say bonds preferentially in tax deferred), then you should use Mode 2. Using Simple or Mode 1 will give spurious answers, with Roth Conversions that are too large.

Check to make sure that you agree with the Effective Tax Rate. I believe the default is 20%, so if you are really only ever 12% and will be below the start of the LTCG tax phase-in, you may want to look at 12%.

@ricke I am not sure I understand the - For instance, since you are near the top of the 12% bracket, you may have some LTCGs being taxed, which creates a zone where extra income like RMDs would be taxed at 27% (12% ordinary + 15% LTCG).

Are you saying that the RMDs are all LTCGs? If so I believe that LTCG at 15% are taxed at only 15%, not 27%.

https://www.fiphysician.com/capital-gains-stack-on-top-of-ordinary-income/

@ricke I am trying to play around with your idea of running Roth conversions with and without bad sequence of returns but am having problems. After running Optimize Roth Conversions on the Analysis/Roth Conversions and getting a value, I then go to Analysis/Run Analysis and enable the Historical Sequence button and chose 1965. The problem is when I go back to rerun the Optimize Roth Conversions, the Historical Sequence Analysis turns off and I get the same result. I am still using PRC Gold 2025 if that makes a difference. What gives 🧐?

No, RMDs are regular income, so taxed at 12%, but the threshold for the LTCG phase-in is based on AGI, so if you are in the phase-in range, a $ of RMDS also increases your AGI, so causes another 15% tax as it exposes a $1 of LTCG to taxes, giving you a total marginal cost of 27%. Once you are past the LTCG phase in, you are essentially at the top of the 12% bracket, so your marginal rate then drops back to the normal 22%. Similar things happen in the ACA premium credit phase-out that can go up to 15% plus your ordinary tax bracket and the SS benefit tax phase-in, where the SS phase-in causes your tax rate to be 1.5 or 1.85 the ordinary income bracket. That's why you need a powerful tool to look at your situation, the tax code is very lumpy and complicated.

In Gold, let's say you start with Conversions enabled. Go to the Historical Analysis and enable the historical sequence. Record the final estate value.

Return to Roth Conversions and Disable them. That also disables the historical sequence, so return to Historical Analysis and re-click the button to enable the historical sequence. In our case, we are mostly past the point where Roth Conversions can help, but with the remaining planned conversions, the base case assumptions provide $40K benefit for Roth Conversions, but if we instead get the 1965 sequence, it is a $33K loss for having done them. Not a huge problem, but folks should realize that it's not all rainbows and sunshine., you make your plan around a given set of assumptions - taxes, life spans, income, expenses, heir's taxes, investment returns, etc. and if those don't work out like you thought, things will be better (or worse).

@ricke Fascinating!!! My Roth conversion (total saving at end of life) was a little less (very little) when using 1965 which I find a little surprising.

@ricke Now try the same thing but now increase tax rates by the max of 25% in PRC starting in the year you stop doing Roth conversions. I would assume that Roth conversions would look a little better even with sequence of returns taken into effect vs not doing any Roth conversions. Thoughts??

@ricke Back to the total marginal cost of 27% question I had. Say a single filler for 2025; 10% tax bracket is $0 to $11,925, 12% tax bracket $11,925 to $48,475, 15% LTCG starts at $48,350, do not count standard deduction for this example. The person has income of $31,925 and LTCG of $20,000 (total of $51,925). Tax on the 10% tax bracket would be $1,193. Tax on 12% bracket would be $2,400. LTCG starts at $48,350, so the amount of money that the 15% tax on LTCG would be applied on would be $3,575 for a tax of $536.25. Total tax owed would be $1,193 plus $2,400 plus $536.25 which equals $4,129.25. The LTCG tax due is stacked on top of the income tax due, so the tax you actually pay on the LTCG is 15% on $3,575. So I still don't see where the 27% comes from, I am confused 😕.

You left off the standard deduction, so rather than inventing more numbers which are really hard to digest in a text format, I'll point you to a decade old article from Kitces.com

I am doing this analysis so I can understand how LTCG is taxed, not to steep on anyone's toes 😍.

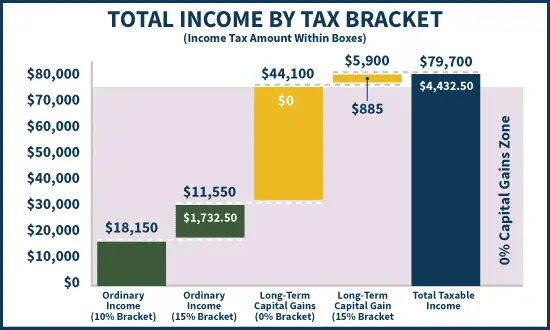

OK, I've read the Kitces article and several others, and, if I am interpreting them correctly, in the words of Ross Pero, "here's the deal". LTCGs do indeed affect your AGI, but they do not affect your income tax rates (brackets). Look at this Figure from the Kitces article (which is a few years old and uses the pre 2017 tax brackets):

There is $29,700 of taxable income, say from your regular IRA (Standard deduction already accounted for). Income tax on that income is taxed at the 10% bracket and the 15% bracket. Income tax due is $3,547.50. As far as income tax due, that's it, your done. Now you put the LTCG on top of your income of $29,700. Your first $ of LTCG starts at $29,701. The top of the 0% LTCG tax is $73,800. So you have a space at the 0% LTCG of ($73,800 - $29,700) = $44,100. The first $44,100 of your $50,000 LTCG is taxed at 0%. The remaining $5,900 of your LTCG is above the $73,800 threshold, so that amount is taxed at 15% ($885). You do not add the 15% income tax to the 15% LTCG. This example has the 15% income tax bracket, not the 12% tax bracket from earlier in this thread. So, as far as I can tell, the $5,900 LTCG is not at a marginal tax rate of 30%. You can check this by looking the the effective tax rate: $4,432.50 / $79,700 = 5.56%. I think that makes sense 😏.

I think we've reached agreement. What I said in my April 2 post was "additional ordinary income (say due to an RMD or Roth Conversion) ends up taxed at 27% as it both increases your ordinary income (12%) and your LTCG taxes (15%) as it increases your AGI."

I brought that up as a possible explanation for why the program would recommend conversions for Tom T at 22% when he will be in the 12% bracket. His RMDs are taxed as ordinary income and some of them may be in the 27% zone.