Pralana Gold integrates and analyzes all of your assumptions and inputs along with detailed tax calculations to create three complementary views into your future. This gives you the best possible insight on which to base important financial decisions.

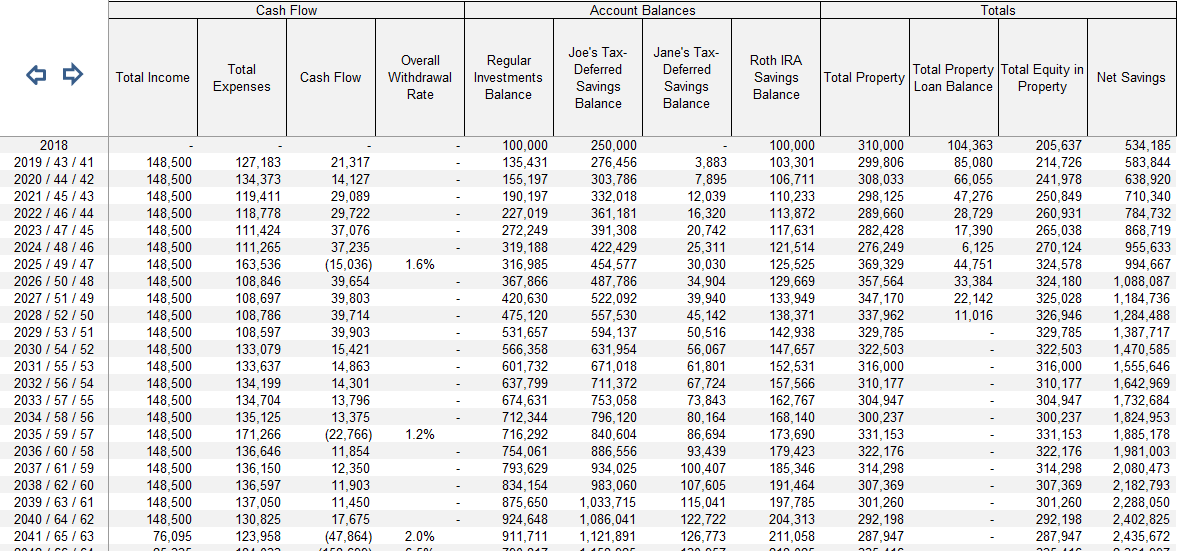

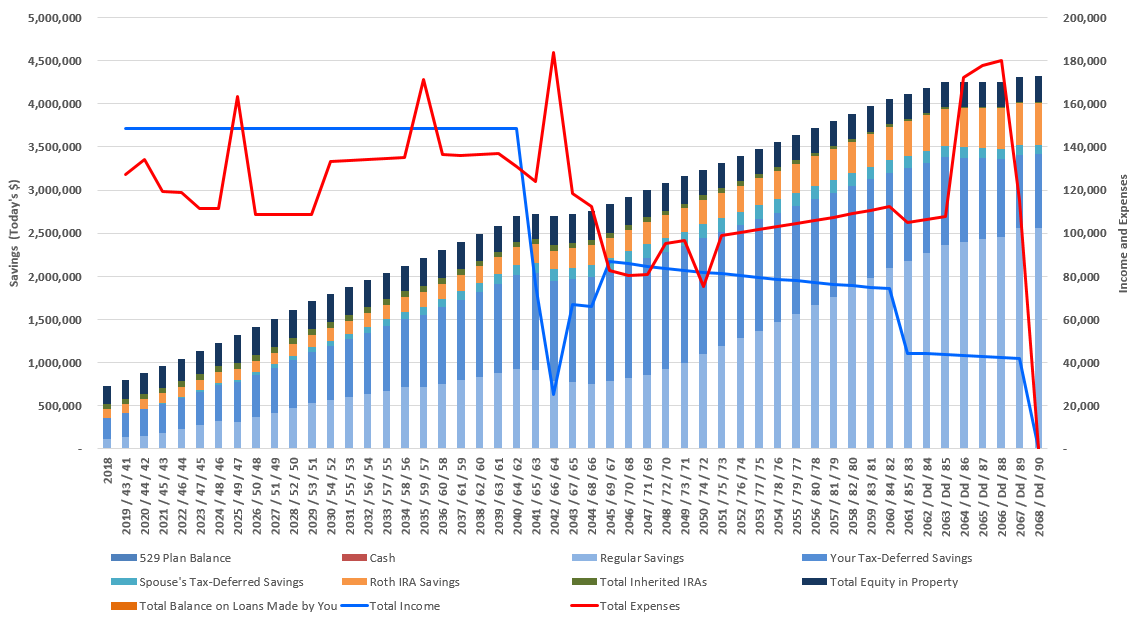

Deterministic analysis results are presented both in tabular and in graphical form to enable you to see future projections in great detail.

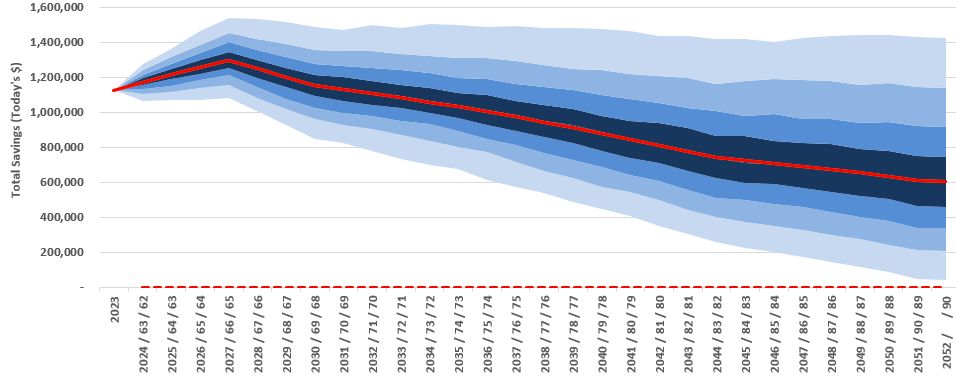

Monte Carlo and Historical analysis results are presented in graphical form to show you the range and distribution of likely outcomes, with the deterministic projection superimposed for comparison. A variation of Pralana’s Historical analysis is its Historical Sequence Analysis. With this capability, you can substitute a specific historical returns sequence (for example, the sequence that began in 1929) for the deterministic projection and the red line on the graph will show how your portfolio would perform if that particular inflation and market returns sequence were to repeat itself.

The blue bands indicate the distribution of Monte Carlo or historical analysis results in terms of percentiles. The red line is the corresponding deterministic projection and can be replaced by a projection based on a particular historical sequence of inflation and market returns.

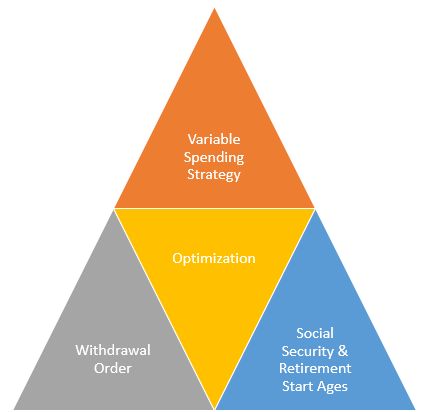

By leveraging the integration of your overall assumptions, accounts, portfolios, income and expenses along with detailed tax calculations, Pralana Gold can calculate optimum strategies that will enable you to maximize your lifetime savings.

Variable spending strategies

Gold enables you to model variable spending strategies in retirement to regulate your non-essential spending as a function of the performance of your portfolio.

If you want to explore variable spending strategies for your retirement years instead of explicitly defining your expenses, Pralana Gold gives you that option! Gold always assumes that property, children, healthcare and life insurance expenses are essential but the remainder of your expenses can be designated by you to be either essential or non-essential. Your non-essential expenses can then be replaced in your retirement years by values generated by Gold’s variable spending algorithms to regulate that spending as a function of the performance of your portfolio, just as you would do in real life!

Pralana Gold models each of these variable spending strategies: fixed % spending (where, for example, you could mimic Bengen’s 4% rule), fixed % spending with floor and ceiling, constant spending, Guyton-Klinger rules, target % adjustment, CAPE rules, and an actuarial method.

withdrawal order

Gold can model and optimize withdrawal order over pre-retirement, early retirement and late retirement periods to achieve the highest final savings balance.

When you have a negative cash flow, you have to tap your savings to cover the deficit. Pralana Gold models this process and it also allows you to decide in which order to place your taxable, tax-deferred and Roth accounts for the withdrawals to cover those deficits. Further, it allows you make different selections for three different time periods, such as pre-retirement, early retirement and late retirement. Your choices tend to make a long-term difference in your overall savings because the taxation of the withdrawals is different for the various account types.

Pralana Gold contains an algorithm that will calculate the optimum withdrawal order for each of the three time periods to achieve maximum lifetime savings across all of your accounts. You then have the option of using that order or one of your own choice.

key start ages

Gold’s optimization algorithm will calculate the date on which both you and your spouse can retire with a 90% confidence level that your money will outlast you. Further, it will calculate the optimum ages for you and your spouse to begin taking Social Security benefits in the context of your overall plan.

Pralana Gold gives you the capability to start and stop virtually all of your income streams on your retirement date. If you use this capability and make this association, Gold can then run a Monte Carlo simulation to determine the earliest such retirement date that will give you a 90% chance of not running out of money in your lifetime.

Pralana Gold has the capability to calculate both your and your spouse’s Social Security benefits based on your planned start age(s), including spousal benefits. Leveraging this capability, Gold can also conduct an analysis to tell you husband and wife start ages that will result in maximum lifetime savings. Unlike calculators that simply tell you the age that results in maximum lifetime benefits, Pralana Gold calculates a solution that takes everything into account, not just earnings but taxes, growth on savings and so on.

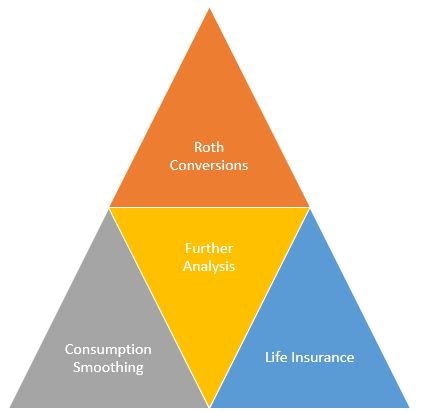

Going even further, Pralana Gold enables you to model and evaluate Roth conversions, incorporate consumption smoothing and calculate the amount of term life insurance you need .

roth conversions

Gold can model and optimize the conversion of pre-tax and after-tax funds from your tax-deferred accounts to your Roth account and these conversions will be incorporated into its detailed income tax calculations. A given amount of money in a Roth account is worth more than that same amount in a tax-deferred account, so Gold will compare the buying power of your portfolio before and after doing these conversions.

To preserve your ACA subsidies during the Roth conversion process Gold gives you the ability to restrict your MAGI to a specified multiple of the Federal Poverty Level (FPL).

To limit your tax liability in each year of the Roth conversion process Gold gives you the ability to restrict your taxable income to a particular Federal marginal tax bracket. You can select different brackets for each year of a 20-year span of time.

To keep your Medicare premiums under control during the Roth conversion process Gold gives you the ability to restrict your MAGI to a specified IRMAA bracket.

While respecting your specified FPL-multiple and IRMAA bracket limits, Gold will compute the optimum marginal tax bracket limits to maximize your long-term savings balance.

consumption smoothing

Gold’s consumption smoothing algorithm provides valuable insights about your plan! First, it can help you maximize your standard of living over the remainder of your life. Second, it can quantify the amount of margin in your plan.

Consumption smoothing is a term used by economists to describe a consistent standard of living for an individual regardless of family size and the ebb and flow of essential expenses. In other words, it enables you to maintain the same level of non-essential spending (i.e., consumption) while you’re raising a family, paying your mortgage, paying for college educations, when you become empty nesters and when you’re retired.

Gold’s consumption smoothing algorithm is fully integrated with its other algorithms that combine your assumptions, current portfolios, income and expenses to generate future projections. So, in the context of all your other inputs, it will compute the ADDITIONAL ANNUAL SPENDING that your plan can support. You may view this as the amount by which you can raise your standard of living. You could also view it as a measure of the amount of spending MARGIN in your current plan.

As you ponder the notion of raising your standard of living, you should be keenly aware of the risk in the values produced by any consumption smoothing algorithm since they’re generally designed to spend all of your money by the end of your life. Values produced by the deterministic projection method generally have a 50% probability of success. Consequently, one school of thought is to project a life expectancy of 100 years to lower the risk associated with the consumption smoothing result. In contrast, Pralana Gold contains a more sophisticated algorithm that utilizes Monte Carlo and historical simulations in conjunction with consumption smoothing to calculate a standard of living with a 90% probability that your money will outlast you.

life insurance

Gold can model term and cash value life insurance, and it can even calculate 10-year term life insurance recommendations to keep the survivor whole in the event of the pre-mature death of his/her partner.